| 15 August 2022 |

Changes to Energy Super products - Insurance |

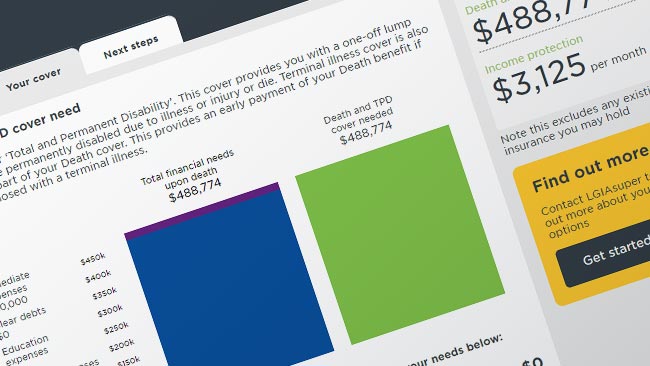

On 19 September 2022, we are standardising the Death and Total and Permanent Disablement (TPD) cover offered to members through their employer.

|

| 8 August 2022 |

Important notice to members about the transition to Brighter Super

|

On 19 September 2022, Energy Super will officially become known as Brighter Super.

To implement the move to the new administration platform, there will be a period where normal member services will be suspended.

|

| 29 April 2022 |

Changes to Energy Super products

|

On 31 March 2022, we made some changes to the investment fees and indirect cost ratios for our investment options.

Find out more here

|

| 18 February 2022 |

Changes to Energy Super products |

On 31 March 2022, Energy Super is making some changes to some of our products.

- Pension members: find out more here

- Accumulation, Transition to Retirement (TTR) and Defined Benefit members: find out more here

|

| 23 December 2021 |

Important changes to Energy Super's superannuation accounts. |

On 20 December 2021, we made some changes to the indirect cost ratios to our investment options.

Find out more here

|

| 9 December 2021 |

Passing on the tax benefit on administration fees and changes to the tax refund on insurance premiums. |

On 1 February 2022, Energy Super (as part of LGIAsuper) is making two changes to the tax refund that you receive for your administration fee and insurance premium.

Find out more here

|

| 8 November 2021 |

Removal of our administration fee of $1 per week ($52 per year) per account. |

On 30 September 2021, Energy Super (as part of LGIAsuper) completely removed its weekly administration fee of $1 per week ($52 per year) per account.

The changes in this Notice apply from 30 September 2021.

Find out more here

|

|

31 May 2021 (email)

7 June 2021 (postal)

|

Changes to the definition of Total Permanent Disablement. |

Due to changes within the insurance policy the Fund made some changes to the definition of Total and Permanent Disablement (TPD). The key changes are the removal of the Activities of Daily Living Definition and the introduction of an “Any Occupation” (Definition 2) that applies to Member’s working less than 15 hours per week or are currently not working.

The changes in this Notice apply from 1 July 2020.

Find out more here

|

|

19 May 2021 (email)

21 May 2021 (postal)

|

Energy Super and LGIAsuper are merging 1 July 2021. |

The merger between Energy Super and LGIAsuper is planned to go ahead on 1 July 2021. The merger between Energy Super and LGIAsuper will be by way of a Successor Fund Transfer (SFT). As part of this SFT process, comprehensive due diligence and an independent review is undertaken by both funds, to ensure the SFT is in the best interest of members overall.

The merger between Energy Super and LGIAsuper will result in your benefits in Energy Super (ABN 33 761 363 685) being transferred to LGIAsuper (ABN 23 053 121 564) (the Fund). The Trustee of LGIAsuper is LGIAsuper Trustee (ABN 94 085 088 484) and Energy Super products will be issued by the Trustee on behalf of the Fund.

The two funds will continue to operate under their existing brands for a period of time, managing more than $20 billion in retirement savings for around 120,000 members.

Find out more here

|

| 30 September 2020 |

Important notice about insurance for members whose employer pays their insurance premium.

|

For members who employer is paying your insurance premiums and you are under the age of 25 or have an account balance that has not exceeded $6,000, if you were to cease employment with that employer your insurance cover will cease on the date you ceased employment. If members are under 25 years of age or have a balance of less than $6,000 and want to keep the cover they currently have, even after leaving their, they must provide the Fund with an Insurance Cover Election Form BEFORE ceasing work with that employer.

You’ll find more information in the important notice sent to affected members.

|

| 30 April - 1 May 2020 (email)

4 May 2020 (postal)

|

Insurance Cover is Changing Notice. |

Following a rigorous tender process, Energy Super (the Fund) has appointed OnePath Life Limited (the Insurer) as its insurer.

OnePath became the insurer for Income Protection on 6 September 2019 providing insurance cover for members in accordance with the terms of our existing Income Protection Policy (due to expire on 1 July 2020) and from 1 July 2020 will be the insurer for Death & Total and Permanent Disablement (TPD). New insurance policies will commence from 1 July 2020.

The changes will affect the cost, benefits and some of the terms and conditions. Find out more here.

|

| 29 November 2019 (email)

1 December 2019 (postal)

|

Putting Members Interest First legislation (insurance cover in super is changing again – you may lose your cover. |

The Federal Government has introduced further legislation which may impact any insurance cover members hold with us. The new ‘Putting Members’ Interests First’ laws take effect 1 April 2020 and require super funds to only provide default insurance to members if:

- They are over 25 years from 1 April 2020 and;

- Their account balance has reached $6,000 or more at any time between 1 November 2019 and 1 April 2020.

This means that unless the member tells us otherwise, Energy Super will be required to cancel their insurance cover on 1 April 2020 if their account balance hasn’t reached $6,000 or more at any time since 1 November.2019. Find out more here

|

| 18-21 October 2019 (postal)

7-21 November 2019 (email)

|

Reduction in indirect administration fees and fee cap for Accumulation members. Reduction in indirect investment costs for all members. |

Energy Super members with an Accumulation account will receive a decrease in their indirect administration fee from 0.22% to 18% from 1 October 2019. This subsequently reduces the fee cap for eligible Accumulation members from $1,100 to $900 pa. All members will also enjoy a decrease in indirect investment costs, depending on the investment option they’ve chosen. Find out more here

|

| 13 June 2019 - reissued |

Various – introduction of unit pricing to Energy Super Defined Contribution accounts; changes from Protecting Your Super legislation; and a new Indexed Balanced investment option. |

New Federal Government laws (Protecting Your Super Package) will come into effect on 1 July 2019. In addition to the change to the rules around providing insurance cover within super that was communicated to affected members on 1 May 2019, the new rules introduce the following changes:

- Removal of exit fees;

- Inactive low-balance accounts to be transferred to the ATO;

- A new cap on administrative and investment fees for low-balance accounts; and

- Amendments to the Work Test exemption rules.

From 11 May 2019, Energy Super Defined Contribution accounts moved from crediting rates to unitisation to show a members’ investment value and change in value over time.

On 6 April 2019, Energy Super introduced a new Indexed Balanced option.

Find out more in the disclosure of changes sent to all members.

|

| 1 May 2019 |

Protecting Your Superannuation Package (insurance cover in super is changing – you may lose your cover. |

New Federal Government laws (Protecting Your Superannuation Package) will come into effect on 1 July 2019. The package involves a change to the rules around providing insurance cover to members within super. The new rules require a super fund to cancel insurance cover for members with an account that has been inactive (no contributions or rollovers received) for 16 months – unless the member tells us in writing that they want to keep their current insurance cover. You’ll find more information in the disclosure of changes sent to affected members.

|

| 7 December 2018 |

Changes to MySuper investment Option. |

As part of the Energy Super Board’s most recent review of the MySuper investment option, a number of changes were made to the investment strategy for the option. The Board is moving the ranges for a number of asset classes to allow changes to the asset classes in response to market conditions, particularly focusing on Growth assets. Effective 1 February 2019. You’ll find more information in the disclosure of changes sent to affected members.

|

| 31 August 2018 |

Impacted service period. |

Energy Super has entered into a partnership with a new administration services provider. This may affect our services to members between Monday 17 and Friday 28 September 2018. Member Online is also being upgraded during this time. Find out how this impacted service period affects your account.

|

| 15 September 2017 |

RG97 legislation (new fee and cost disclosure). |

The Government has made changes to the regulations that govern how super funds display some of their investment fees and costs. These changes will take effect from 30 September 2017. The intention is for funds to be more standardised and transparent in disclosing the expenses they incur when they manage your super or income stream investment. You’ll find more information in the disclosure of changes sent to all members.

|

| 1 June 2017 |

Increase to Death & Total and Permanent Disablement (TPD) and Extended Income Protection (IP) insurance cover policies. |

On 1 July 2017, Energy Super’s Death & TPD and Extended IP insurance cover policies and terms will change. The changes will affect the cost, benefits and some of the terms and conditions. There is also a change to the indirect costs for our Australian Shares investment option. You’ll find more information in the disclosure of changes sent to all members. |

| 5 September 2016 |

Various – change to admin cost rebate, new non-lapsing death benefit nominations, new ceasing Income Protection (IP) cover rules and a new provider of standard IP insurance. |

Energy Super has capped the fees on balances over $500k at 30 June each year. The cap is now $1,100 (previously the account balance threshold was $1m and the cap was $2,200). Non-lapsing death benefit nominations are now in place at Energy Super. Unlike binding nominations, a member with a non-lapsing nomination is not required to renew their nomination every three years. New IP ceasing cover rules are in place to protect members from paying for IP cover they don’t need. And finally, a reminder that Energy Super has a new standard IP provider and some changes to note. You’ll find more information in the Some things you should know about notice sent to members in their annual statements delivered in September and October. |

| 5 August 2016 |

Change to Energy Supers insurer for Income Protection Insurance. |

From the 5 September 2016, a new Income Protection (IP) insurer - MLC Limited will provide Standard IP insurance for Energy Super Members. The change will not affect the current cost of Standard IP cover. For some members, the changes will have no impact. For others, the changes may have some impact depending on their age, current level of cover and conditions surrounding their employment. The most important change affecting all member is the reduction in the amount paid after 120 days into the benefit period. The level reduces from 90% of your income to 80% of your income. The 10% paid into super remains the same. You will find more information in the Some things you should know about notice sent to all members. |

| 29 February 2016 |

Increase to Income Protection (IP) premiums for Standard IP cover with 30, 60 or 90 day waiting period. |

From 1 April 2016, Income Protection (IP) costs for members with 30/60/90-day waiting periods will increase by 5%. You will find more information in the Some things you should know about notice sent to members eligible for this cover. |

| 23 February 2016 |

Increase to Income Protection (IP) premiums for Standard IP cover with a 14 day waiting period and Extended IP cover with a 2 year and 14 day waiting period. |

From the 1 April 2016 members with a 14-day waiting period, the cost of Standard Income Protection (IP) will increase by an extra 5% above the existing 5% indexation increase (as outlined in the current Energy Super Insurance Guide). The level of cover for these members will also increase via an indexation rate of 5% from their 2015 level. You will find more information in the Some things you should know about notice sent to members eligible for this cover. |

| 18 December 2015 |

Increase to the lost super threshold. |

The Government has increased the account balance threshold below which small accounts need to be sent to the Australian Taxation Office. This ‘lost super’ threshold increased from $2,000 to $4,000 from 31 December 2015. Energy Super members aged under 55 were advised of this in the Fund’s member newsletter, a printed copy of which was sent on 18 December 2015. Members aged 55 and over will be advised in early 2016. |

| 29 May 2015 |

Closure of Cash Deposit Investment option. |

Effective 1 July 2015, Energy Super’s Cash Deposit option will close. This effects:

- Accumulation members who are currently invested in and/or have selected for their future contributions the Cash Deposit option Income Stream members whose account balance is invested in and/or regular income stream payments are drawn from the Cash Deposit option.

- Affected members were sent a letter advising them that the portion of their investment in the Cash Deposit option would be automatically moved to, and their choice for future contributions or income stream payments changed to the Cash Enhanced option from 1 July 2015 – unless they made an alternative investment choice.

The letter explained the options available to the member. It also outlined the differences between the Cash Deposit and the Cash Enhanced options, and included a Change of Investment Choice form and reply paid envelope.

|

| 29 May 2015

|

Disclosure of underlying investment costs. |

In the interests of transparency, Energy Super has chosen to disclose the underlying investment costs to members. These include fund of fund structures, brokerage, buy sell spreads and property management fees on the underlying investments.

You will find more information in the Disclosure of underlying investment costs notice sent to all members.

|