-

Superannuation

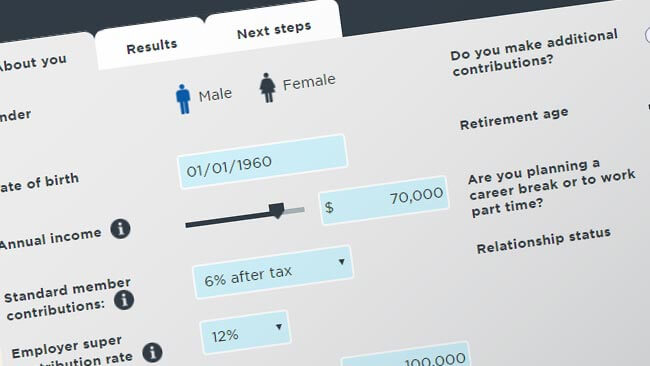

Super Health Check

Brighter Super offers 30-minute Super Health Checks over the phone, video conference or in-person where we can help you discover new ways to grow your superannuation, and check that you are on track for a comfortable retirement.

-

Retirement

David ‘Kochie’ Koch

Join Kochie and the Brighter Super team at upcoming events that will help guide you through your superannuation journey and retirement planning.

-

Investments

Unit prices

Daily indications of performance for each investment option as a daily movement percentage and a financial year to date percentage.

-

Advice

Advice

Good advice is key to helping people achieve financial prosperity and security in retirement.

-

Resources

Let's Learn

Learn how to grow your superannuation with our educational e-learning modules. You can discover different ways to build the lifestyle you would like when you finish work.

- Member Online

-

Superannuation

Super Health Check

Brighter Super offers 30-minute Super Health Checks over the phone, video conference or in-person where we can help you discover new ways to grow your superannuation, and check that you are on track for a comfortable retirement.

-

Retirement

David ‘Kochie’ Koch

Join Kochie and the Brighter Super team at upcoming events that will help guide you through your superannuation journey and retirement planning.

-

Investments

Unit prices

Daily indications of performance for each investment option as a daily movement percentage and a financial year to date percentage.

-

Advice

Advice

Good advice is key to helping people achieve financial prosperity and security in retirement.

-

Resources

Let's Learn

Learn how to grow your superannuation with our educational e-learning modules. You can discover different ways to build the lifestyle you would like when you finish work.

- Member Online